News

CIBIL Credit Report What is Credit score & How to check

Borrowing and lending are concepts that most people are acquainted with. You might have encountered a few people who frequently forget to repay their borrowed money. Due to their forgetfulness, it makes you reconsider lending to them. Similarly, lending organizations want to make credit and bank cards available exclusively to people who they believe are creditworthy. This CIBIL score check is another of the important measures used by Indian finance companies to assess an individual’s trustworthiness.

What exactly is the CIBIL Score?

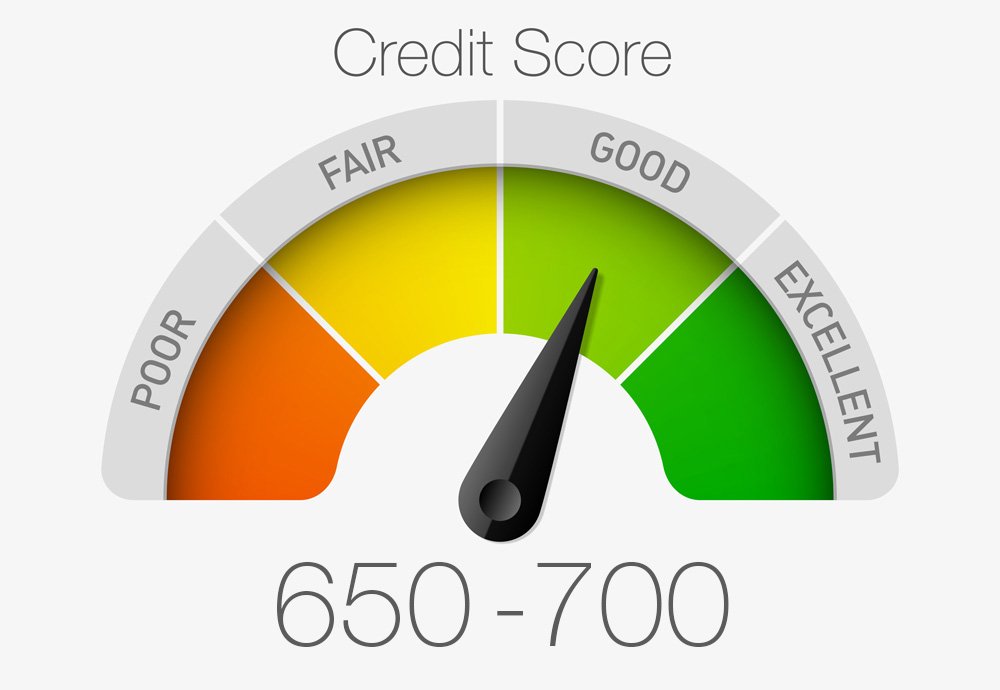

When a loan application is received from a person, the CIBIL rating is among the most crucial variables that practically every banking firm looks at. TransUnion CIBIL works with almost every financial institution to assess the trustworthiness of thousands of consumers and businesses. A good CIBIL score indicates your strong financial management skills and your honesty. When you ask for a personal loan or perhaps a bank card, your most current score (from the past six months) is reviewed. In general, every number above 700 has been recognized as outstanding, while some financial institutions set the bar higher, and others are willing to reduce the requirement.

Who determines the CIBIL Score?

TransUnion CIBIL would be India’s initial credit agency or credit reporting firm, founded around 2000. The corporation computed persons’ CIBIL scores based on customer information maintained in its database. They are well-known for the precision and clarity they calculate the score.

How do I check my credit score?

Here is how to check your CIBIL score:

- Go to TransUnion CIBIL’s authorized webpage. This website provides you with a CIBIL score-free check option.

- Hit the ‘Check Yours Immediately’ option underneath the ‘Personal’ category for a complimentary CIBIL rating on the front page. After paying the necessary fees, you may acquire a complete report by clicking on ‘Acquire Your CIBIL Rating.’

- If users choose a complimentary CIBIL rating, then customers will be routed to a website that will ask them to fill in their details at the initial stage. The second stage in the registration process is to confirm personal identification with any government-issued identification proof.

- You may sign in with your profile if you already have one.

- Your credit rating will be delivered to your registered email address.

What are the components influencing your CIBIL Score?

History of reimbursement:

Financial institutions and non-banking finance companies view a poor credit history as a sign of future actions. Each time you take out a loan or credit, the bank must update it to CIBIL. The bank keeps track of whether you settle your obligation on schedule. It is considered a great indication if you attempt to settle in early. This demonstrates that you can be relied on to reimburse the amount you owe.

Credit increased significantly:

You might possess a credit limit as a working person, either for a credit card or perhaps a bank card. Utilizing these to the capacity implies a credit-hungry attitude, which banks regard as a warning indicator. Your credit score may suffer if you keep a specific credit limit every month but suddenly start spending much more.

debt-to-earnings ratio:

Lenders usually do not encourage customers to put on additional debt, perhaps 40 percent of their earnings. As a result, DTI assesses an individual’s capacity to repay debt depending on their earnings. This is a wonderful metric for instilling financial discipline and ensuring that you repay upcoming monthly installments without feeling pressured.

Several pending loans:

Lenders will always be concerned if you have too many credits in your possession, such as a house loan, a handful of private loans, an automobile loan, plus bank cards on top of that. It is usually preferable to complete one before beginning the next. Priority should be given to closing the lesser debts as quickly as possible.

How to obtain a CIBIL report?

It is incredibly simple to acquire your most recent CIBIL score immediately through TransUnion CIBIL’s official webpage.

Stage one:

Each individual is entitled to a complimentary CIBIL rating assessment once a year. When you have already availed of this offer, you must choose one of the premium options listed below:

Membership for one month – Rs. 550

Membership for 6 months – Rs. 800

Membership for 12 months – Rs. 1,200

Stage two:

Fill out the online application with your personal information.

Stage three:

Type the captcha displayed in the checkbox, click the box that says accept the rules and restrictions and go to the checkout page.

Stage Four:

You will get your credit rating in your inbox within a day of completing the payment and confirming your account.

A better credit rating can provide many advantages, such as cheaper borrowing costs, but a lower rating might result in loan requests being denied. It is easy to keep a solid credit rating to obtain financial help when needed. However, a personal loan with a low CIBIL score is not good.