Entertainment

Mortgage Refinance – Why You Should Refinance Your Mortgage

A good company offers mortgage refinance Toronto for individuals with a low-interest rate. If your credit is poor, you can change to a fixed-rate mortgage. A mortgage broker can help you decide whether you are a good candidate. You can save thousands of dollars with mortgage refinancing. Read on to learn more about it! Below are some of the benefits of mortgage refinancing Toronto. We have compiled a list of the best mortgage companies in Toronto to help you get the lowest rate possible.

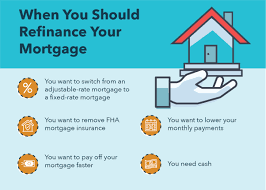

There are several reasons to refinance your mortgage. Refinancing may be a more affordable alternative to taking out a second mortgage. You may need money for education fees or home renovations. In addition, you may want to change your repayment schedule – either to get a lower monthly payment or to increase the size of your mortgage. In either case, a Mortgage Refinance Toronto is the best option. Once you get your debt under control, you can look into a mortgage refinance in Toronto.

You may be able to find a better rate if your income or credit score has improved. The longer your mortgage is, the cheaper the refinance loan will be. However, bad credit history may prevent you from qualifying for a lower interest rate during the housing pandemic. Get in touch with Loans Geeks to learn more about home equity loans Toronto.

Mortgage Refinance Toronto is a new trend in Canada. It’s an opportunity to obtain a better interest rate and conditions on a second loan on the same mortgage. Mortgage refinancing Toronto is becoming an increasingly popular way to get a new loan. Once you get the terms and conditions, it’s time to apply for a loan. You may be surprised by how easy it is to get a second mortgage in Toronto.

Refinancing is a process of changing existing mortgages with new ones. Mortgage loans Toronto allows you to increase the total amount of your mortgage. If you have one, you may also combine a first and second mortgage. It’s a great option for many people in different circumstances and may give you more money than you thought you would. If you’re a homeowner in Toronto, consider mortgage refinancing for your home.

A good mortgage broker will help you decide whether mortgage refinancing is right for you. They understand your financial situation and know what mortgage math requires. Refinancing is not guaranteed. However, it requires a reappraisal of your home, a new title search, and other fees. In addition, your home may have dropped in value since your first mortgage. Loans Geeks can give you a great consultation on home equity loan rates Toronto. If this is the case, you may not have enough equity to qualify for a refinance.

A Mortgage Refinance Toronto firm will help you find the lowest interest rate and make your new loan payment easier. Refinancing also provides you with more flexibility when it comes to loan terms. Refinancing allows you to access the equity in your home, which could save you money over the long term. It can also improve your credit score, give you a chance to apply for a better loan, and get a lower interest rate.