Business

Risk Tolerance What’s Right For You

Your risk tolerance is a measure of how much risk you are comfortable with taking. For some people, risk means taking a chance to make a big profit, but for others, it means enduring market swings and the possibility of a loss. Risk tolerance is an important element of investing. A healthy balance between risk and reward can help you reach your financial goals. Read on to find out what your risk tolerance is.

Financial Resources

The risk capacity of an individual varies from person to person, depending on their time horizon and financial resources. For example, if a person is trying to retire in five years, their risk tolerance questionnaire capacity may be higher than the risk tolerance of a person in that time. Likewise, if someone has debt or financial obligations, their risk capacity may be lower. However, many experts recommend using risk capacity as a guide for investment decisions.

Aggressively Less Nervous

Age and financial security also play a role in risk tolerance. Young people may be comfortable taking on a higher level of risk than older investors. If they have a good job and little debt, they may be more aggressive. Older people may be less risky, but they may not be as comfortable with the potential for loss. If you’re younger, you may want to invest more aggressively and be less nervous.

Crucial Factor Investing

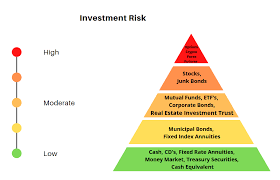

Your ris tolerance is a crucial factor in investing. While you might have a higher risk tolerance, you may still need to invest conservatively to protect your money. In a lower risk-reward environment, you may want to diversify between stocks and bonds. In an aggressive market, a large amount of your money might go into high-risk assets and only a small amount in low-risk assets. In a moderate market, the opposite may be true.

Strategic Objectives

Risk Tolerance is the amount of risk you’re willing to take in order to achieve your strategic objectives. However, you should not accept risks that could result in a significant loss of revenue, or a decline in the revenues of your top 10 customers. Moreover, you should be aware of the residual risk and operate within it, which will help you achieve your strategic goals and ensure you’re managing the actual risk exposure.

Potential Profit

A high risk level will mean a higher return, while a low risk level will mean less potential profit. Ideally, your risk tolerance is somewhere in between. However, there’s no right answer to this question, as every person has different risk tolerance levels. While you should never invest in high risk assets, it’s always wise to have some safety net in your portfolio. You’ll never regret it!

The answers to these questions can help you better plan your finances. Your goals, timeline, and personality will determine what investment strategy will work for you. Risk tolerance is an important element of investment planning, and knowing your own level of tolerance is key to sticking with your plan. So, take the quiz to find out your risk appetite. It’s fun, and it might help you make better investment decisions in the future.

Low Risk Tolerance

How High is Your Risk Tolerance? You must consider this before investing. A low risk tolerance means that you should stick with lower-risk investments, while a high risk investment will mean a higher risk. A high risk tolerance, however, means that you should avoid putting all your eggs in one basket and expecting huge returns. However, high risk tolerance is possible for anyone if they only know how to handle risk. The best time to determine your risk tolerance is when stocks are falling.

Final Thoughts:

Your risk tolerance depends on your risk appetite and what you’re willing to take on. If you don’t mind taking on a certain amount of risk, moderate-risk investments are ideal for you. If you want to generate significant income, aggressive growth investors will use higher-risk strategies. They may invest up to 100% of their money in equities. If you’re a speculative investor, risk tolerance is all about risk versus reward.